Michael Calia - 07/16/2021

Properly conducting surveys optimizes content marketing efforts while building brand equity and thought leadership. Follow these tips to gain the best data to help expand your business.

Proprietary data gathered by quality market research is a strong brand building block. Don’t just take my word for it, though. Lego, Apple and Verizon dedicate time and resources to surveys to help build their brands. Plus, nearly three in four readers find content with data to be more trustworthy than material without it.

Proprietary data gathered by quality market research is a strong brand building block. Don’t just take my word for it, though. Lego, Apple and Verizon dedicate time and resources to surveys to help build their brands. Plus, nearly three in four readers find content with data to be more trustworthy than material without it.

The question is, “How does a company gather valuable data from surveys to position itself as a thought leader and raise its brand to the level of those Fortune 500 corporations?” Read on to learn about some key guidelines for conducting strong surveys.

Know Your Audience

Every effective content marketing program knows who will be digesting the information. This is especially true for surveys, as the questions posed will need to help draw the conclusions that will interest your target audiences.

For example, in a previous blog post, we examined how understanding the unique concerns faced by eCommerce businesses as a result of the COVID-19 pandemic helped pivot the original strategy to yield a more relevant study. Understanding what your target audience would want to know helps you plan an effective survey that helps draw important conclusions.

Identify Your Objectives

Because the survey data will be used for content marketing, it’s imperative to establish an overarching goal when constructing the questions. In many cases, there may be multiple objectives. For example, Dotcom Distribution’s 2021 eCommerce Study sought to gather more insight into online shopping habits in a post-COVID world. This information is valuable for Dotcom Distribution as a business, as they’re able to identify how consumer preferences relate to online order fulfillment operations. At the same time, the annual survey positions the brand as a thought leader, presenting proprietary information that reinforces why growing eCommerce brands need experienced fulfillment partners to sustain growth in today’s market.

Balance Depth with Simplicity in Questions

The logic of knowing your audience extends to those taking your survey. Make answering the questions as easy as possible without sacrificing the value of their answers. Here are some tips to make that happen:

- Consider what the ideal participants would typically know and not know.

- Use language that clearly and concisely demonstrates what you’re asking, so each person understands every question and gives appropriate responses.

- Avoid technical jargon that may not be universally known.

- Limit the amount of open-ended questions. They are often more difficult to quantify and analyze.

Multiple choice questions are an easy way to avoid these pitfalls. They allow respondents to complete surveys quickly without too much effort. Plus, a defined list of answer choices helps create consistency in responses for more valuable and usable results.

Ask What Respondents Have Done, Not What They Would Do

In most cases, it’s more useful to know how certain consumers acted in certain situations than how they would act. Previous actions are more indicative of behavior. For example, someone saying they would book an impromptu vacation to Hawaii is a lot different than someone saying they have actually done it.

There are exceptions. If a survey objective is to gauge consumer opinion on something in the near future, knowing a respondent’s plans is more beneficial. In the aforementioned Dotcom Distribution study, one goal was the determine which habits shoppers picked up during the pandemic will remain in a post-pandemic world. Because of this, shoppers were asked what they will do in the future, as to better assess how their activity in a given timeframe altered their attitudes moving forward. Regardless of what timeframe you’d like respondents to describe, make sure your questions are clear, so the response data is accurate.

Understand Media Value

To achieve maximum return on investment (ROI), part of your strategy should involve media relations. Consider media appeal when crafting the survey. Research some of the most discussed topics in the industry and determine how certain survey aspects can be valuable to outlets that reach your target audiences.

With a proactive public relations strategy, you can use relationships with key media to know the exact information they will want and tweak designated survey questions accordingly. This creates a win-win scenario. Your brand receives valuable editorial placements and the outlets have stories that are of interest to their readers, listeners, watchers and visitors. Receiving the third-party endorsement associated with editorial coverage helps expand your brand’s reach and elevates your leadership position.

Even if certain study aspects highlight commonly known consumer tendencies, adding a quantifiable value can provide more appeal. If your data can dispel common myths about a given topic, that will likely gain more attention. A good rule of thumb is to consider what headlines can be generated by responses. If something doesn’t pose any use on its own or when paired with other information, it may not be as important to ask.

Compare Responses Across Demographics

Overarching statements highlighting respondents’ opinions and actions are useful to draw conclusions. Add value by pairing it with analysis of how these behaviors differ among demographic groups. It’s important to filter answers according to factors such as geographic location, household income, and education to show how they affect opinions and activity.

Brands often adjust messaging and strategies to appeal to specific segments of these groups. Demographic questions should also be included to provide an overview of participants. This will help build credibility and create a more accurate representation of the group you are summarizing.

Let Results Fuel Content Creation

It’s a no-brainer that your survey should fuel one overarching study. The content shouldn’t stop there, though. Once you have sufficient proprietary data, craft more materials to enhance your content marketing strategy.

Ideally, survey results can fuel a few blog posts that offer deeper dives into valuable points. This is crucial because companies that blog frequently receive 55% more website visitors than ones that don’t. Key data points can also be used to craft attention-grabbing social media post copy to spur engagement and further expand your brand’s presence.

When using the survey results in your content marketing and social media strategy, it’s important to provide a direct link to a lead-generating landing page. It allows users to download the full survey with a quick form fill. It also helps build your prospect database for future marketing efforts.

Pair Data with Graphics

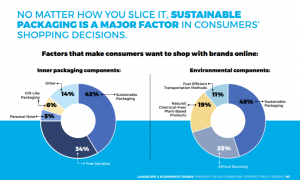

When analyzing and compiling response data, explanations and insight should come with high-quality visuals. Simple charts and graphs can help keep users interested and easily break down specific points. In fact, people are more likely to retain information paired with images, so creating a graphical presentation of your findings can help readers understand and recall the data. Just be sure to know when and how to use each type of graph so readers can easily understand the data.

If you’re interested in the benefits surveys can provide in your content marketing and public relations strategies, feel free to email me to discuss how to make the most out of them.