Michael Calia - 05/28/2020

Adjusting a yearly eCommerce survey strategy allowed for in-depth analysis of how online shopping preferences changed in the face of the COVID-19 pandemic.

To better monitor the constantly evolving demands of consumers, Dotcom Distribution, an Edison-based provider of B2C and B2B fulfillment and distribution services, conducts a yearly eCommerce study. Over 1,000 online shoppers are surveyed about their expectations and demands while buying items online. Along with providing the third-party logistics (3PL) partner with knowledge on how to optimize strategies to better satisfy consumers, the insight found in the study brings tremendous value from a public relations and marketing perspective.

However, the COVID-19 pandemic has created overwhelming changes to the online retail industry, while also dominating most news headlines. Recognizing these challenges, 3E PR and Dotcom Distribution made significant adjustments to the 2020 survey strategy to gather data that would be useful for online brands and media alike.

The Original Strategy

Prior to the store closures and stay-at-home orders, the 2020 eCommerce Study was developed similarly to previous years. The main goal was to provide an in-depth analysis of how online shopping preferences evolve from year to year, emphasizing the fulfillment and logistics aspects of the online purchasing journey. As the eCommerce giants make things like free shipping and next-day delivery more easily available, consumers grow more accustomed to them, and the features become basic expectations of online shopping. Recognizing this and the challenge it presents to emerging brands, Dotcom Distribution aims to quantify how strong these features can be for improving customer satisfaction. The study presents other opportunities for new brands to better allocate resources and attract more first-time buyers and repeat customers.

Certain questions remain unchanged with each yearly survey for benchmarking purposes, allowing for more direct analysis into how specific preferences have evolved in 12 months. For example, Dotcom Distribution’s 2019 Study found that in-store returns of online purchases grew in importance from the previous year, indicating that a true omnichannel shopping experience became more valuable for boosting customer satisfaction and sales. While omnichannel retail and returns are often key focus areas of the survey, other questions relate to packaging preferences, shipping transparency, and more. 3E PR also monitors key industry media to highlight new trends with each year’s survey.

This year’s survey involved an emphasis on shoppers who purchased premier apparel, accessories and cosmetic products – specialty areas of Dotcom Distribution. Responses from these premium shoppers were compared to those who did not purchase such products to highlight the key differences in their expectations. Data was also filtered according to respondents’ ages to determine how certain preferences and expectations differed among age groups. While it came as no surprise to see that premium shoppers had more heightened expectations than the typical consumer, the specific data would allow brands to assess their own strategies to better satisfy such valuable customers.

This year’s survey involved an emphasis on shoppers who purchased premier apparel, accessories and cosmetic products – specialty areas of Dotcom Distribution. Responses from these premium shoppers were compared to those who did not purchase such products to highlight the key differences in their expectations. Data was also filtered according to respondents’ ages to determine how certain preferences and expectations differed among age groups. While it came as no surprise to see that premium shoppers had more heightened expectations than the typical consumer, the specific data would allow brands to assess their own strategies to better satisfy such valuable customers.

COVID-19 Caused an eCommerce Overhaul

Because the survey was initially constructed in early February and results were gathered in early March, the data reflected consumer preferences before COVID-19 changed the state of shopping as we know it. At this time, the common safety procedure for shopping in physical stores was simply regular handwashing. While we all knew the dangers of the coronavirus and the proper protocols for helping reduce the spread, many did not expect such a rapid shift as the virus swept through the country. Furthermore, respondents answered questions under the assumption that they actually had the option to shop in-store. While the insight still held value from a retail perspective, most media likely wouldn’t be interested in publishing articles about a study that gauged shoppers’ opinions before such a massive overhaul in shopping habits. Dotcom Distribution CEO Maria Haggerty said, “Having launched Dotcom Distribution just as the dotcom bubble burst, and then navigating our way through the aftermath of 9/11, I can confidently say the eCommerce industry has not faced a more transformational period than the COVID-19 pandemic.”

Last-Minute Change of Plans

Recognizing how the pandemic changed the media landscape by dominating headlines, 3E PR acted quickly to adjust the strategy and obtain more relevant data. Constructing a follow-up survey that specifically addressed shoppers’ post-COVID attitudes would allow for a better view of how consumers were purchasing items online now that there was practically no in-store option. These questions also excluded essential items such as food, cleaning supplies and medicine, so they would identify preferences and attitudes pertaining to shopping for items that fit Dotcom Distribution’s specialty areas. With many people losing jobs due to the pandemic, experts expected the purchase of non-essential items to slow down. The new questions aimed to gather relevant data by seeing how people were avoiding online shopping due to financial uncertainty. Along with analyzing the changes in demands during the coronavirus crisis, this follow-up survey also sought to assess online shoppers’ long-term habits after the pandemic ends. The resulting data provided value for brands looking to prepare for the return to normal life, allowing them to properly adjust their strategies to more effectively meet consumer demand.

Addressing New Challenges

The new plan seemed simple, but it created unique obstacles to overcome. A key challenge involved ensuring that the new post-COVID survey data would build off the original survey, not disregard it. While there were definitely areas of the original survey that were obviously reflective of a different time, it still held value if served up properly. These aspects were used in tandem with post-COVID data to better quantify how shopping preferences changed so quickly. Creating a story that dissected the before-and-after would be a more beneficial strategy than only showing the most recent results with no comparison at all.

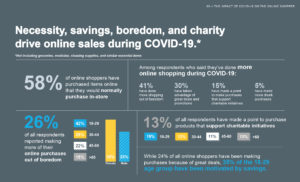

As a previous 3E blog post explained, the COVID-19 crisis should cause a significant pivot in your public relations strategy, and this case is no different. While media may have been focusing exclusively on coronavirus, there was still the challenge of presenting unique information. People will obviously take their shopping online when brick-and-mortar stores were closed, so presenting this stat alone would provide little value to media. One resolution involved identifying data that painted a more positive picture to stand out among the overwhelming amount of negative news. For example, the post-COVID survey found that certain shoppers reported being more interested in making purchases that support charitable initiatives. Additionally, the data indicated that many online shoppers would also support local businesses when possible. These two points emphasize the fact that people will often look to help others get through tough times, so giving them an outlet to do so can enable them to provide more support while also bolstering a positive brand image.

Dotcom Distribution’s 2020 eCommerce Survey found that COVID-19 caused online shoppers to purchase out of necessity, savings, boredom and charity.

When our team was constructing the original survey, we often forecasted how the response to a question could be used as a headline. We took the same approach when constructing the post-COVID survey, as each question needed to present attention-grabbing information that would be valuable to our target consumer and trade publications, as well as emerging business leaders. One question revealed that many people took to eCommerce as a source of entertainment, evidenced by a significant amount of online shoppers making more purchases strictly out of boredom, and others partaking in the modern activity known as “drunk shopping.” Looking at this data broken down by age groups and genders also revealed which demographics were more likely to make purchases when they’re bored or after they’ve had a few drinks. With modern media often using certain data points to immediately hook readers and encourage them to read more, stats like these could present opportunities to secure valuable coverage.

As the new survey was constructed, it was paramount to ensure the overall objective remained clear. The data had to be appealing to media, but it also needed to identify opportunities for brands to optimize fulfillment strategies to meet consumer demand. Though not every question added in the post-COVID survey directly addressed specific order picking, packaging and shipping strategies, the overall data was used to enforce the narrative that modern retail businesses need sound fulfillment operations to sustain positive growth. In the event of a catastrophe that leaves brick-and-mortar stores closed, one negative online shopping experience can sour a brand’s reputation for good. Businesses looking to sustain growth through difficult times must minimize all mistakes, and doing so requires knowing how to prevent them.

The Final Results

By creating a follow-up survey that addressed the topic everyone was talking about, 3E PR was able to secure coverage highlighting the specific impact coronavirus had on online shoppers. Dotcom Distribution’s study was published in Women’s Wear Daily, a key fashion industry outlet read by some of the most influential minds in the apparel business. Along with appearing in front of several potential new clients, the placement also adds SEO value. A link to Dotcom Distribution’s website was published on a website with a strong domain authority, allowing the Edison-based 3PL to appear at more favorable positions in search results for those who may be looking to outsource fulfillment operations of their eCommerce business.

Dotcom’s 2020 eCommerce Survey can be utilized in marketing efforts. In a past blog, I discussed how to leverage certain tools in a successful content marketing strategy. In this case, offering the full study as a CTA can be used to generate quality leads and expand Dotcom’s growing business. Furthermore, several pieces of the survey can be expanded upon in various blog posts. By adding to their already voluminous blog, Dotcom Distribution can reinforce its position as a thought leader in the industry by examining key ecommerce trends and explaining what brands can do to adapt, thus reaching more customers and boosting sales.

Are you considering conducting a survey or similar study to create valuable piece of marketing content or generate media coverage? Email me to discuss how to best adjust your strategy to meet your objectives.